Effective Backlink Strategy for SEO Success

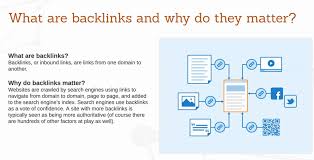

Backlinks are a crucial element in any successful SEO strategy. They not only drive traffic to your website but also signal to search engines that your site is a reputable and valuable resource. Developing a strong backlink profile requires a well-thought-out strategy that focuses on quality over quantity.

Key Elements of a Successful Backlink Strategy:

- Natural Link Building: Focus on creating high-quality, valuable content that naturally attracts backlinks from other reputable websites.

- Relevant Links: Seek backlinks from websites that are relevant to your industry or niche. Relevant links carry more weight in search engine algorithms.

- Diversification: Build a diverse backlink profile by acquiring links from various sources such as blogs, news sites, directories, and social media platforms.

- Authority Sites: Aim to secure backlinks from authoritative websites with high domain authority. These links have a greater impact on your site’s ranking.

- Anchor Text Variation: Use a mix of anchor text variations when acquiring backlinks. This helps create a natural link profile and avoids over-optimisation penalties.

- Ongoing Monitoring: Regularly monitor your backlink profile using tools like Google Search Console or third-party services to identify any toxic or spammy links that may harm your site’s ranking.

The Benefits of an Effective Backlink Strategy:

An effective backlink strategy can significantly boost your website’s SEO performance in the following ways:

- Increase in Organic Traffic: Quality backlinks improve your site’s visibility in search engine results, driving more organic traffic to your website.

- Enhanced Domain Authority: High-quality backlinks contribute to your site’s domain authority, making it more trustworthy in the eyes of search engines and users.

- Better Search Engine Rankings: A strong backlink profile can help improve your site’s ranking for targeted keywords, leading to increased exposure and higher click-through rates.

- Improved Brand Reputation: Backlinks from reputable sources enhance your brand’s credibility and reputation within your industry.

In conclusion, implementing an effective backlink strategy is essential for achieving long-term SEO success. By focusing on quality, relevance, diversity, and ongoing monitoring, you can build a robust backlink profile that boosts your website’s visibility and credibility online.